We would like to show you a description here but the site won’t allow us. Find Pelco by Schneider-Electric software downloads at CNET Download.com, the most comprehensive source for safe, trusted, and spyware-free downloads on the Web. Pelco Corporations. Alluvial, Fresno, CA 93711 View Map +1 (559) 292-1981. Schneider Electric Continuum; Schneider Electric Security Expert; Siemens; Zenitel. Like Lenel, Software House, Sensormatic and several other foundational companies, Pelco sold out to international building automation giant Schneider Electric in 2008 for $1.2 billion, which at.

Transom Capital Group has acquired Pelco Inc, a provider of video surveillance solutions, from Schneider Electric. No financial terms were disclosed.

PRESS RELEASE

FRESNO, Calif., May 29, 2019 /PRNewswire/ — Transom Capital Group (Transom), a leading operations-focused middle market private equity firm, today announced it has acquired Pelco, Inc. (Pelco), a top provider of video surveillance solutions, from Schneider Electric.

Pelco is a global leader in the design, development, and manufacturing of predictive video security solutions including cameras, recording and management systems, software, and services. Pelco’s personal engagement with customers, resellers and technology partners drives the development and deployment of surveillance and security solutions with meaningful innovation.

Russ Roenick, Managing Partner at Transom Capital Group, said, “As most security industry experts know, Pelco is one of the pioneers of the video surveillance space. The journey toward creating the next great breakthroughs in video security begins today through our investment in Pelco. We have conviction that the work done over the past several years to transform the Company into a digitally-savvy security leader with innovative hardware, software, and service solutions is nearly complete. We are excited to partner with management to grow the business for many years to come.”

Jean-Marc Theolier, CEO, Pelco, Inc., “As we surveyed the landscape of potential partners, our primary goal was to commit with a company who appreciated Pelco’s legacy, as well as supported our current business strategy and growth plan. Transom strongly believes in our unique value proposition to be an end-to-end solutions provider, and has encouraged us to continue doing what we do best! We are excited to work with Transom, and to develop new and innovative solutions to best serve our business partners.”

Terms of the transaction were not disclosed. Transom was represented by Latham & Watkins as M&A counsel and Perkins Coie as debt finance counsel on this transaction. Wells Fargo provided the debt financing for the transaction. R.W. Baird served as financial advisor to Pelco on this transaction.

About Transom Capital Group

Transom (www.transomcap.com) is a leading operations-focused private equity firm in the middle market with more than $500M in assets under management. The firm’s functional pattern recognition, access to capital, and proven ARMOR Value Creation Process combined with management’s industry expertise to create improved operational efficiency, significant top-line growth, cultural transformation and overall distinctive outcomes. Transom is headquartered in Los Angeles, California.

About Pelco, Inc.

Pelco is a global leader in the design, development, and manufacturing of predictive video security solutions including cameras, recording and management systems, software, and services. From its VideoXpert video management platform to its industry-leading selection of IP cameras and accessories, Pelco is committed to designing and delivering a broad range of high-quality, IP video security products and systems that make the world a safer place.

Source: https://www.pehub.com/2019/05/transom-acquires-pelco-from-schneider-electric/

Powered by WPeMatico

Schneider Electric has entered exclusive negotiations with investment group to divest its video business

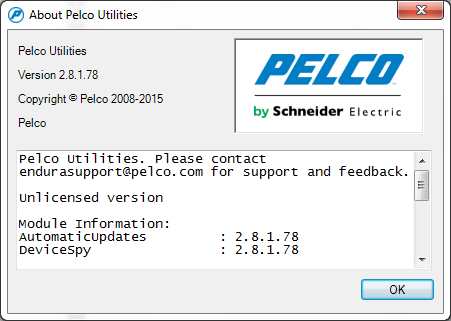

Drivers Pelco By Schneider Electric

During what might be considered the security technology industry’s “golden age” more than two decades back, it was a world of bold ideas and brash entrepreneurs, a start-up that sought a stable future not the next venture capital investor to sell to. It was into this world that Pelco Sales morphed from a small aviation joy-stick manufacturer in Gardena, California, to one of the most prestigious video surveillance device companies on the planet in the late 1980s under the guidance of CEO David McDonald and team. Moving to a state-of-the-art technology campus of more than 80,000 square feet in Clovis, the “new” Pelco continued to innovate and expand internationally.

The company then took the same road several of its contemporaries did in the late 1990s and early 2000s by hitching its future to a corporate behemoth. Like Lenel, Software House, Sensormatic and several other foundational companies, Pelco sold out to international building automation giant Schneider Electric in 2008 for $1.2 billion, which at the time was the largest acquisition of an analog video camera manufacturer. In the years that followed Pelco’s technology edge dulled as Schneider failed to integrate a workable course for growth, sparking continual rumors of acquisition and sale.

This past week the rumors of a Schneider Electric divestiture of Pelco seem to be an eventual reality. According to Reuters, Schneider entered into exclusive negotiations with U.S. private equity firm the Transom Capital Group regarding the sale of the Pelco business unit. The guess among security business experts is that Transom Capital is looking to reinvigorate Pelco’s product and image and help improve on the $185 million in revenues reported for 2018.

“Unfortunately for Schneider, the deal was never a success. While Pelco was a profitable company, it did not have the IP network camera technology which subsequently went on to dominate the market over the succeeding 10 years. IP networked products now have the largest share of the video camera market and are continuing to grow,” says James McHale, Managing Director for Memoori, a consultancy company based in Stockholm providing independent market research, business intelligence and advice on Smart Building technologies to companies across the value chain.

Losing its clout as a leading camera solutions provider after the Schneider sale, Pelco sought to target enterprise vertical market segments in the emerging video management software side of the surveillance business with modest success.

Drivers Pelco By Schneider Electrical

McHale points out that back in 2008, IP network camera technology was still emerging, and many skeptics doubted it would overtake analog.

“If Schneider had taken a serious look at Axis Communications, a leader in IP Network Cameras back then, they could certainly have acquired it for less than $1.2 billion. Now roll forward to 2015; Axis was acquired by Canon for $2.8 billion and today would probably not sell for less than $4 billion,” chides McHale.

There are no public figures on the asking price for Pelco by Schneider executives, however, they did admit to booking a non-cash loss on disposal of up to $250 million, the net impact of which would be excluded from the net income used for dividend calculation.

According to McHale, if the reports are valid, Pelco is unlikely to sell for more than

$200 million.

“So, sadly for Schneider, they backed the wrong horse. But hindsight is a wonderful thing,' adds McHale.